Accursia Capital makes binding offer for Ahlstrom Stenay mill

August 1, 2023

Canfor reports operating loss of $67 million

August 2, 2023

Significantly lower sales volumes and lower sales prices pushed half-year and quarterly results of Finnish forest products group UPM down to a noticeably lower level compared to the previous year.

President and CEO Jussi Pessonen said markets had contracted rapidly and sharply and the company had sold far less than projected end demand would have led it to expect. Geopolitical uncertainties, low economic activity, and high inflation had affected consumer behavior, and some global commodity prices, such as pulp and energy, had fallen from historic highs to cyclical lows in six months. The fact that sales volumes for most of UPM’s products were significantly below average in the second quarter was also influenced by customers’ destocking.

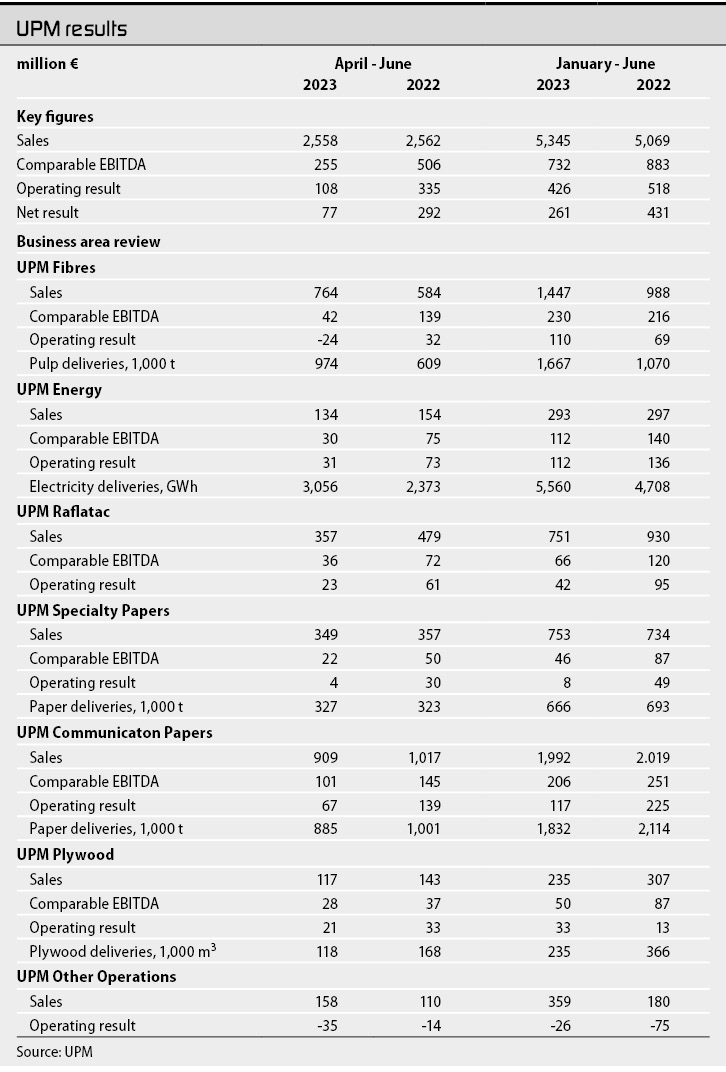

UPM generated Ebitda on a comparable basis of €732m (2022: €883m) and an operating profit of €426m (€518m) on sales of €5.35bn (€5.07bn) in the first half of 2023. Profit after tax amounts to €261m (€431m).

In a market characterized by flat sales volumes and falling selling prices, results of the Communication Papers and Plywood divisions held up well, UPM reports. The Raflatac and Specialty Papers divisions succeeded in unit margin management, but the continuing slump in sales volumes caused results to shrink. Fibres and Energy increased sales, but selling prices were significantly lower.

UPM responded to the changed market situation and structure with temporary production cuts, cost management, and capacity closures. In the second quarter, PM 6 at the Schongau mill and PM 4 at the Steyrermühl mill were shut down in the Communication Papers business unit. In addition, the company recently announced the closure of its Plattling mill towards the end of the year. UPM stated that it would continue to adjust its production capacity in this business area to the development of demand while maintaining profitability.

For the second half of the year, UPM expects its comparable Ebit to be similar to the first half and for the full year 2023 to be lower than 2022. In terms of deliveries, UPM expects higher volumes in the second half of the year than in the first six months, partly because the company expects the general destocking to phase out. Sales volumes will then gradually converge with actual end-customer consumption, UPM assumes.

UPM also expects the ramp-up of the Paso de los Toros pulp mill and the commissioning of the OL3 nuclear power plant to make a positive contribution to the company’s sales volume.